Citi Savings Match

Today's banks are focus on milestone-driven financial planning. However, 61% of Americans don’t even have over $1,000 in savings to cover unexpected expenses like hospital bills or to fix their car. This idea for a new in-app feature establishes a savings life-line for those unexpected expenses. Its a national digital bank account that’s self funded—without ever having to change how a user spends their money.

User Research

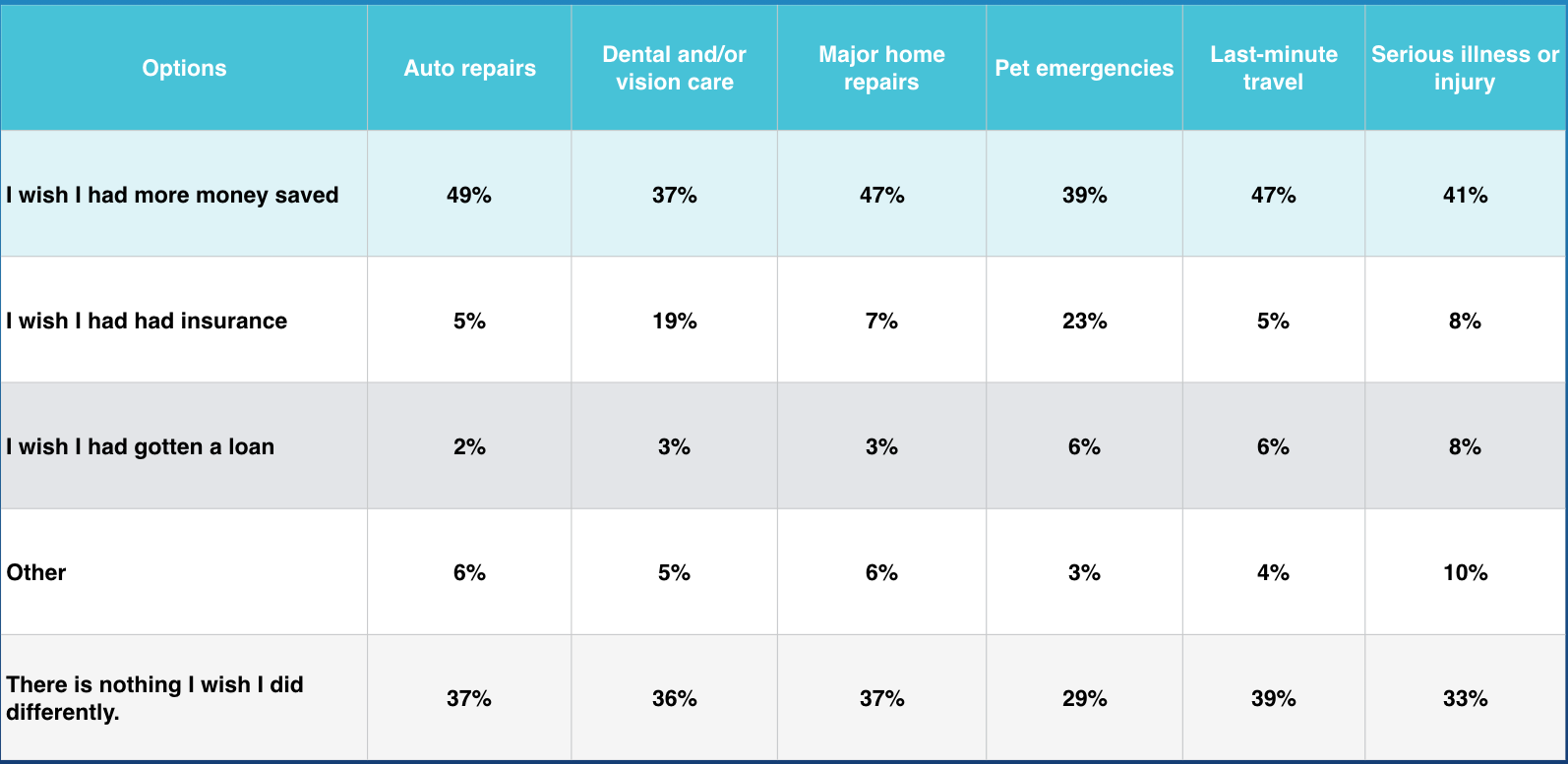

We reached out to over 500 customers and potential customers and the average household is being hit with unforeseen costs for things like medical expenses as well as home and auto repair in the range of $2,000 to $6,0000. As most of these customers didn't have $1,000 in savings, this issue presents itself as a high stress situation with no easy solution. When we asked what would make them feel more comfortable during this difficult time, they overwhelmingly said being able to save more or being better at saving. While we also heard a few mention products such as insurance and loans, most customers just wished they were more prepared with additional savings.

While there are similar apps in the market place (Acorns auto-invests spare change, Robinhood offers free investment & trading, etc) all of these apps are dependent on behavioral change. None consider that users might want to make saving decisions based on their lifestyle and spending habits. So if they love how they’re already living their lives and don’t want to sacrifice life’s little luxuries, why not leverage that?

From a business/technology perspective, after speaking to Citi developers I discovered we could leverage our existing transfer API which utilizes transaction messages that already exist within our mainframes. From there it took one evening to create a proposed swagger API to transfer recurring funds between Citi accounts and the Citi savings match fund.